Birla Group Share Price

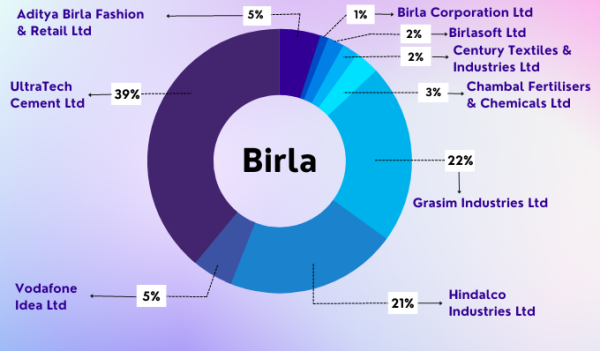

The Aditya Birla Group is one of India’s biggest and most respected business firms. Its reach extends across industries like cement, metals, fashion, finance, and real estate. Projects like Birla Evara benefit from the trust and performance of their parent group. A closer look at the Birla Group share list shows why investors have long believed in their stability and growth.

Birla Group Share Price List

Here is Birla Group’s share price list for some of its major listed companies. Please note that share prices change frequently. These values are only examples and may not reflect the current market.

- UltraTech Cement Ltd – ₹11,607.80, India’s top cement maker

- Grasim Industries Ltd – ₹2,652, Has interests in textiles and real estate

- Hindalco Industries Ltd – ₹653, A global leader in aluminium and copper

- Aditya Birla Capital Ltd – ₹193, Offers loans, insurance, and investment services

- Aditya Birla Fashion and Retail Ltd – ₹264, Owns top brands like Pantaloons and Allen Solly

- Vodafone Idea Ltd – ₹8.19

These numbers provide a glimpse into the financial strength and scale of the Aditya Birla Group. Each company plays a role in contributing to the group’s market value and credibility.

Factors Affecting Share Prices

Many factors influence share prices, including those in the Birla Group share list:

- Company Performance: Good profits and strong growth usually lead to a rise in share prices.

- Market Conditions: Bull markets push prices up, while bear markets can bring them down.

- Global Events: Changes in oil prices, wars, or economic trends worldwide can affect Indian shares.

- Government Policies: Tax changes, interest rate decisions, and real estate regulations may impact company earnings.

When looking at any company in the Birla Group share price list, it’s wise to think about these variables before making decisions.

Though Birla Estates is not listed separately on the stock exchange, it is part of Grasim Industries Ltd., which makes it easy to follow its financial influence. So, Grasim’s performance gives a fair idea of how well Birla’s real estate business is doing.

The success of projects like Birla Evara shows that the group’s real estate arm is focused on quality, timely delivery, and future-ready infrastructure. It is developing in the prime surroundings of Kodathi Village on Sarjapur Road. The location is close to IT hubs and city conveniences, makes it a preferred address for professionals and families alike.

The project is a premium residential offering in Bangalore. It is backed by the solid foundation of the Aditya Birla Group. Residents get more than just luxury homes—they enjoy the trust that comes with a powerful brand name.

The Birla Group’s share price, especially across companies like UltraTech, Grasim, and Aditya Birla Capital, reflects a consistent history of performance. When such a group enters real estate with projects like Birla Evara, it signals quality and trust for homebuyers.